Santa Barbara County’s unfunded pension liability up 73%

By KAREN VELIE Santa Barbara County’s unfunded pension liability increased 73% in one year, primarily because of poorly performing investments and higher than predicted cost of living increases. The Santa Barbara County Employees’ Retirement System reported an unfunded pension debt... (Continue reading)

SLO County’s unfunded pension liability soaring, nearly $1 billion

By KAREN VELIE San Luis Obispo County’s unfunded pension liability is almost $1 billion, primarily because of huge pay raises and poorly performing investments. The SLO County Pension Trust Board of Trustees reported an unfunded pension debt of $943 million... (Continue reading)

Protect SLO, oust Heidi Harmon and Carlyn Christensen

OPINION by JIM DUENOW San Luis Obispo needs a new mayor and city council. In the 50 plus years that I have lived and practiced law in SLO, this is the most important election I can remember. Our city now... (Continue reading)

Cuesta College in deficit spending, union pushing raises

While the Cuesta College Board of Trustees is looking at strategies to offset a $551,000 budget deficit, the faculty union is pushing for higher pay. [Cal Coast Times] Lower enrollment coupled with increased unfunded pension liabilities have led to the... (Continue reading)

CalPERS move leaves SLO with multi-million dollar shortfalls

Following the California Public Employee Retirement System’s (CalPERS) recent decision to lower its investment forecasts, the city of San Luis Obispo is facing skyrocketing pensions costs. As result, also because of slowing tax revenue growth, the city is facing a... (Continue reading)

CalPERS lowers investment forecasts, liabilities to increase

By JOSH FRIEDMAN The California Public Employees Retirement System (CalPERS) has decided to lower its discount rate from 7.5 percent to 7.0 percent, which will cause pension costs to rise for state and local government agencies. CalPERS’s discount rate is... (Continue reading)

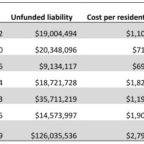

Employee costs and pension liabilities accelerating in SLO

By JOSH FRIEDMAN The city of San Luis Obispo’s unfunded pension liabilities have risen to $126 million, more than the rest of the cities in SLO County combined. After the bottom fell out of the housing market, the majority of... (Continue reading)

California has a surplus, but retirement liabilities remain

A few years after California faced a $26 billion deficit, lawmakers are debating how to spend a budget surplus. However, state officials have not tackled California’s unfunded pension liabilities problem, which is continuing to grow. [Contra Costa Times] The state... (Continue reading)

Pismo Beach pays $1 million to reduce pension liability

Pismo Beach City Council voted unanimously on Tuesday to approve a $1 million payment to reduce the city’s unfunded pension liability costs. Currently, the city has an unfunded pension liability of $13.6 million. This includes $6.3 million in the safety... (Continue reading)

Has SLO gotten a grip on its pension problem?

By JOSH FRIEDMAN Ahead of Tuesday’s vote on San Luis Obispo’s half-cent sales tax, state pension reports have emerged indicating that the city’s unfunded liabilities have decreased slightly, but its annual retirement costs will likely rise by several million dollars... (Continue reading)