SLO County places 3 year sunset clause on low-cost housing fees

March 14, 2019

The San Luis Obispo County Board of Supervisors voted 5-0 on Tuesday to amend the controversial Inclusionary Housing Ordinance and Affordable Housing Fund with a three-year sunset on inclusionary housing if other sources are developed to provide funding for low-cost housing. [Cal Coast Times]

Under the new rules, any home under 2,200 square feet is exempt from in-lieu fees, paid by developers that are then dedicated to low-cost housing. As part of the vote, the board also formalized the county’s CEQA guidelines in order to streamline the environmental review process and increase housing production in the county.

The money raised from inclusionary housing fees is given to nonprofit developers, such as Family Care Network and Habitat for Humanity, which build homes for people with low income. Nonprofit builders can leverage that money to obtain millions of dollars in federal and state housing funds. The county is seeking $2 million to $4 million a year in funding to support matching monies for grants.

Other forms of possible funding include a vacation rental fee, the cannabis tax, increasing the transient occupancy tax rate by 1 percent, a percentage of natural growth (a no-tax option), an affordable housing bond, and increasing sales and property tax rates. The board of supervisors plan to discuss the new funding options in about three months.

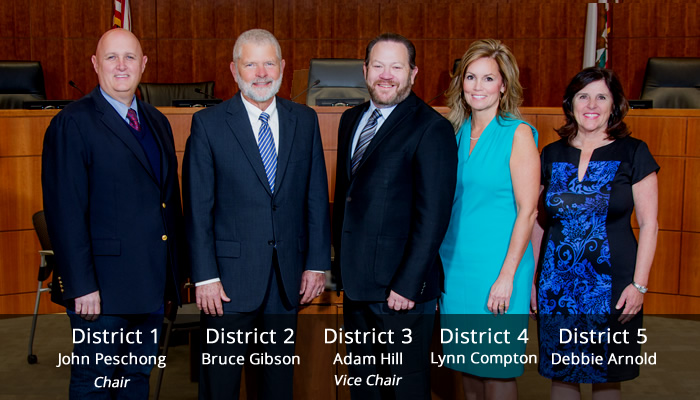

For years, supervisors Lynn Compton and Debbie Arnold have been in favor of a program aimed at providing more workforce housing by reducing fees and relaxing requirements, while Gibson and Hill have voted against it. At the same time, Hill and Gibson have promoted the Inclusionary Housing Ordinance, which requires developers to build homes that are sold at below-market prices or pay in-lieu fees, while Compton and Arnold have been opposed.

In the past, Gibson and Hill have said the inclusionary housing fees are necessary, and that nonprofit builders provide crucial services to the county. On the other side, Arnold and Compton argue that development fees drive up the cost of homes, making housing less affordable.

On Tuesday, supervisors John Peschong, Arnold, Compton, Hill, and Gibson were primarily in agreement with the changes made to the Inclusionary Housing Ordinance, the Affordable Housing Fund, and county CEQA guidelines.

The comments below represent the opinion of the writer and do not represent the views or policies of CalCoastNews.com. Please address the Policies, events and arguments, not the person. Constructive debate is good; mockery, taunting, and name calling is not. Comment Guidelines