Average home price in San Luis Obispo County now over $900,000

November 24, 2024

By KAREN VELIE

With a 5.03% increase in property values during the past fiscal year, the average price for a home in San Luis Obispo County is now $901,111, according to a SLO County Assessor’s Office annual report released Sunday. Ten years ago, the median home price was $477,308, or about half of what is is today.

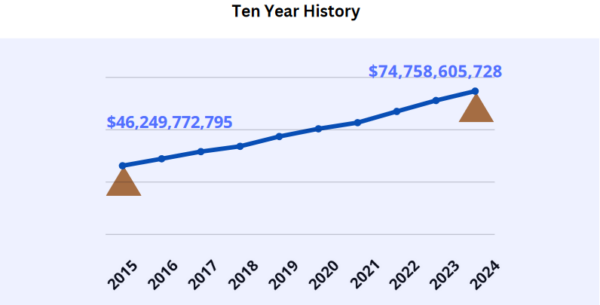

The total assessed value of all property in San Luis Obispo County increased last year by $3,580,404,235 for a total of $74,758,605,728. Changes in ownership, inflation and new construction were the largest factors leading to the increased value.

Where assessed values increased the most:

San Luis Obispo, up 6.7%

Paso Robles, up 6.4%

Atascadero, up 5.3%

Grover Beach, up 5.4%

Morro Bay, up 5.4%

Pismo Beach, up 5%

Arroyo Grande, up 4.4%

San Luis Obispo County unincorporated, up 4.3%

Where do the taxes go?

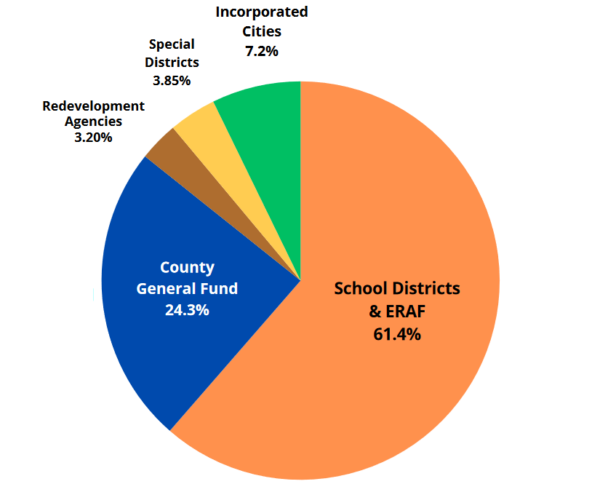

During the 2024-2025 fiscal year, the county is slated to collect $756,987,321 in property tax. Of that, 61.4% goes to schools, 24.3% to the county general fund, 7.2% to cities, 3.85% to local districts and 3.20% to redevelopment agencies.

The comments below represent the opinion of the writer and do not represent the views or policies of CalCoastNews.com. Please address the Policies, events and arguments, not the person. Constructive debate is good; mockery, taunting, and name calling is not. Comment Guidelines