This week’s San Luis Obispo County government meetings

June 3, 2024

By CalCoastNews staff

The San Luis Obispo County Board of Supervisors will meet at 9 a.m. on June 3, June 4 and June 5 in the board chambers.

Over three days, the supervisors will discuss and consider the fiscal Year 2024-2025 recommended budget, including special districts, according to the agenda. The proposed county budget totals $993,748,366.

Under the current board of supervisors majority, which voted to no longer prioritize road work, the amount of local general fund contribution to roads has plummeted. A few years ago, the county allotted approximately $13.9 million to roads, and now it’s down to $6.5 million.

The Paso Robles City Council will meet at 6 p.m. on June 3 and at 5:30 on June 4 in the council chambers.

On May 3, staff will provide a report on the budget, according to the agenda. The council will receive and file the report, and also provide direction on fiscal years 2024-2025 and 2025-2026 budget items outlined within the report.

On May 4, the council will meet in closed session at 5:30 p.m. to discuss a lawsuit demanding the city stop collecting an 11.5% “franchise fee,” which is paid by the public through the city’s waste hauler, Paso Robles Waste Disposal, because it is taxation without a vote of the people.

In Aug. 2022, the California Supreme Court ruled the City of Oakland was not able to show that their franchise fees were not a tax. The Supreme Court then remanded the case back to the trial court, with likely more to come.

Arguing franchise fees are a tax, which have not been approved by the voters in violation of Proposition 218, in his suit Paso Robles resident John Borst is demanding the city stop collecting the excess fee. The city is allowed reimbursement for the cost of managing the franchise, which is likely around .5% and not the 11.5% the city currently collects.

However, with city attorney’s making money through litigation, it is possible the Paso Roble’s city attorney will want to fight the suit.

The Pismo Beach City Council will meet on June 4 at 5:30 in the council chambers.

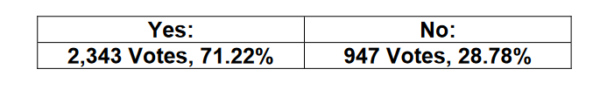

Ten years ago, during the June 4, 2014 general election, Pismo Beach residents voted to pass Measure I, which continued a previously approved half-cent sales tax measure that was first approved in 2008. The sales tax was set at 7.75% for 12 years, or until March 31, 2027. It is a general tax, with revenue going to the city’s general fund for any governmental purpose. It was approved by the following result:

Under item 12-B on the agenda, staff is asking the council to agree to put an extension and an increase of the sales tax to 1% on the Nov. 5 ballot. If the proposed ballot measure is approved by the voters, the new sales tax rate will be 8.25%

Currently, the city receives about $2 million per year from the sales tax. Visitors pay approximately 63% of this tax, generating the bulk of the sales tax based off goods purchased or restaurants visited while they are shopping in Pismo Beach, according to staff. As a result, residents pay only 37% of the total proceeds collected.

The San Luis Obispo City Council will meet June 4 at 5:30 p.m. in its council chambers.

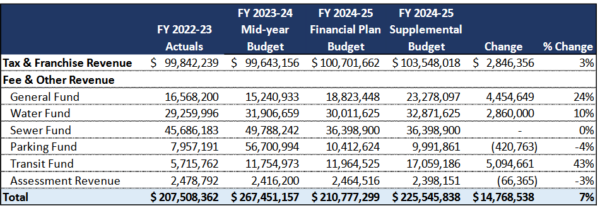

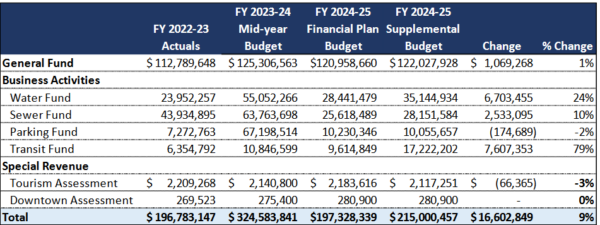

Staff is asking the city council to approve the fiscal year 2024-2025 budget along with allocations noted in the supplemental budget, under item 6-a on the agenda.

Anticipated city revenues total $225,545,838, up 7% from the previous fiscal year.

Estimated expenses total $215,999,457, up 9% from the previous fiscal year.

The Los Osos Community Services District Board will meet on June 6 at 6 p.m. in the board room.

The San Miguel Community Services District Board will meet on June 6 at 6 p.m. in the board room.

The San Simeon Community Services District Board will meet on June 6 at 6 p.m.

The Templeton Community Services District Board will meet on June 4 at 9:19 at a.m. in the board room.

The comments below represent the opinion of the writer and do not represent the views or policies of CalCoastNews.com. Please address the Policies, events and arguments, not the person. Constructive debate is good; mockery, taunting, and name calling is not. Comment Guidelines