Lawsuit exposes former Mindbody CEO’s tainted deal

April 3, 2023

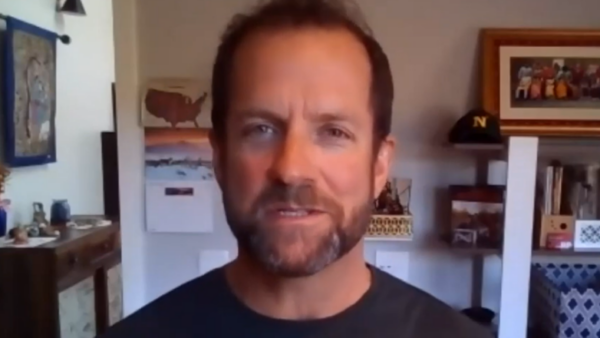

Rick Stollmeyer

By KAREN VELIE

A Delaware court ordered former Mindbody CEO Rick Stollmeyer and Vista Capital in March to pay approximately $48 million because of Stollmeyer’s breach of his fiduciary duties to Mindbody shareholders during the sale of the then-publicly owned company.

While courting Vista, the company that bought and now runs Mindbody, Stollmeyer tanked stock prices and shared inside information with Vista, according to a 120-page decision. The court found that Stollmeyer breached his duties to shareholders when he “greased the wheels” for Vista.

Chancellor Kathaleen St. Jude McCormick ruled in favor of former Mindbody shareholders on March 15, awarding damages of $1 per share, plus interest, or about $48 million. The judgement was based on evidence of what Vista would have paid without Stollmeyer’s interference.

In 2018, Stollmeyer “had grown frustrated with his inability to monetize his holdings of Mindbody stock, fearful of the volatility and fickleness of the public markets, and uncertain about his ability to lead Mindbody through its next stage of its growth,” according to McCormick’s opinion. In order to solve his problems, Stollmeyer decided it was time to sell.

Before Mindbody’s board began to search for a merger partner, Stollmeyer had already selected Vista, though he did not tell the board. Stollmeyer also failed to inform the board that he had attended a summit where he learned of the great wealth Vista delivered to former CEOs of companies they obtained.

Vista aided and abetted Stollmeyer’s breach of fiduciary duties when they signed off on his inadequate disclosures, according to McCormick’s opinion.

“Stollmeyer suffered a disabling conflict because he had an interest in near-term liquidity, a desire to sell fast, and an expectation that he would receive post-merger employment accompanied by significant equity-based incentives as a Vista CXO,” according to McCormick’s opinion. “Stollmeyer tilted the sale process by strategically driving down Mindbody’s stock price and providing Vista with informational and timing advantages during the due-diligence and go-shop periods.”

The comments below represent the opinion of the writer and do not represent the views or policies of CalCoastNews.com. Please address the Policies, events and arguments, not the person. Constructive debate is good; mockery, taunting, and name calling is not. Comment Guidelines