Will SLO successfully deceive voters that taxes are an investment?

October 28, 2020

Richard Schmidt

OPINION by RICHARD SCHMIDT

Question: What kind of city asks its voters to approve tripling its sales tax without mentioning the words “tax” or “sales tax” on the ballot where they must decide?

Answer: San Luis Obispo.

To me, this fact about Measure G-20 exemplifies the current trust bankruptcy of our once well-governed city.

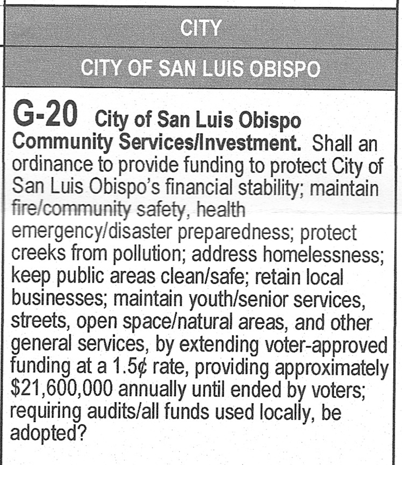

Here’s a shot of the G-20 ballot:

Which sounds peachy-keen, but what does it mean? An ordinance? Financial stability? Protecting fire fighting? Ending pollution? Extending voter-approved funding? And a cool $21.6 mil to do all this with! Who could be against it?

The problem is this measure isn’t a peachy-keen feel-good solution for the world’s ills, it’s a sales tax that triples the local tax we now pay and – unlike previous city sales taxes — will have no sunset date. Shouldn’t those simple facts be stated on the ballot?

There are other deceptions. We’re adopting “an ordinance.” What ordinance? There’s no ordinance in the ballot pamphlet. Indeed, if one reads there carefully one discovers it is necessary to call city hall and get them to mail a copy. I wonder how many they mailed out? Every voter who didn’t request one would have no clue what the “ordinance” says or from where its “funding” might come. Failure to provide the ordinance to all is calculated to keep us in the dark.

There’s the phrase “until ended by voters,” which is supposed to make people think that’s possible. Including this bait was pollster-inspired. Taxpayer-funded city pollsters found a tax more likely to pass if it had a sunset date – like the 8-year sunset of our current tax that continues to 2023. But if you’re dumping the sunset altogether, might as well put in some wording that sounds enough like a sunset to fool voters.

There are two ways a “by voters” repeal can happen. One is for the city council to place repeal on the ballot. Unlikely!

The other way is via citizen initiative petition. That means a costly and Herculean citizen effort: hiring a pricey out of town expert lawyer to write and defend the petition when the city instigates a nuisance lawsuit to try to prevent the vote; circulating the petition till – using today’s city population – it has about 4,000 valid signatures of registered city voters (to get that many valid signatures means you’ll need closer to 6,000 actual signatures); running a campaign which will be opposed by the city, developers, the Chamber, and other vested interests that will have profited from G-20.

Fair to say G-20 will never be “ended by voters.” The phrase is there only to deceive.

But the biggest ballot wording heist is the long list of peachy-keen stuff we can supposedly assure by voting for the mysterious “ordinance.” As I’ve described in my previous articles on the city’s sales tax shenanigans, every one of these points was pollster-tested to make us want to vote yes. For G-20, even that wasn’t enough; after being poll-tested, ballot wording was also focus-grouped.

After all that, the pollsters found with this deceptive wording 70% of us will vote yes.

This list of vote-getting bait is plain dishonest. The tax goes into the city’s general fund and cannot be designated for any of the listed stuff. The only honest item in the list is “other general services,” to which 100% of the tax must go.

I’ve never before seen such intentional trickery in a ballot text. This trickery was not accidental – it was meticulously crafted by pricey staff-hired consultants, recommended to the city council by staff, edited by a council sub-committee (Andy Pease and Erica Stewart), and approved unanimously by the council.

The developer-Chamber of Commerce economic establishment, which controls city hall, jumped on board. Well, actually they didn’t have to jump aboard after the fact; they’d been there all along, conniving with staff.

There is no innocence to be pleaded here. The act of deceit was planned. It took the focused effort of many to pull it off.

Curious late in game wording change. The version of G-20’s wording poll-tested, focus-grouped, and recommended by consultants is not exactly the wording on the ballot. Somebodies at city hall altered wording late in the game.

There are numerous nit-picky wording changes in the list of vote-bait goodies, but they’re nervous tinkering rather than substantive.

But towards the text’s bottom there’s a substantive change which converted a bad and deceptive text into a very bad, even more deceptive, and confusing one.

The consultant text described the action authorized by G-20 this way: “by extending Measure G at a 1.5 cent rate…” While G-20’s wording still would not have revealed it is a sales tax, this wording offered a clue since voters who’ve lived in SLO for a while might remember “Measure G” as our last sales tax vote.

But as you can see above, that wording isn’t on the ballot. In its place G-20 states “by extending voter-approved funding at a 1.5 cent rate . . .” That’s nebulous at best, and it removes the only clue a voter might have that G-20 is a tax. In fact, it tells us nothing and begs the question what “voter-approved funding?”

According to a staff report the night the council put G-20 on the ballot, these changes were made by a council subcommittee of Andy Pease and Erica Stewart.

I asked both Pease and Stewart if that is true, and if so to explain the change that omitted extending Measure G in favor of one nobody would understand. They chose not to respond.

Screwing the opposition with sneaky timing. Staff placed G-20 on the July 21 council agenda, a date mere days before the deadline for placing anything on the November ballot.

That placement was a surprise to all but those in the know. True, the city had talked about doing a new sales tax measure – maybe this year, maybe in 2 years when the current tax would be approaching its sunset date. But as far as the public knew, nothing definitive had been decided.

The public’s ignorance is understandable. This city staff likes to catch the likely-to-be-critical public unawares. It makes little effort to keep in the loop others than its simpatico vested interests. The veil of Covid has made things seem even more secretive. And we live in a civic news desert, where neither of our “newspapers” keeps us informed of pending stuff that affects our lives, like this tax measure.

So the abrupt placement of G-20 in its full glory – tripling the tax and making it last forever – was sprung on opponents, who had almost no time to organize or do essential stuff like getting a ballot argument assembled and turned in. In fact, the city, by running out the election clock, left them with a scant 3 days to get a ballot argument turned in instead of the customary longer time. One can thus surmise the delay in taking G-20 to the council was deliberate; there was no constraint on doing it earlier nor on being a lot more public about staff’s intentions as to the type and extent of the proposed tax.

Of course, the pro-G-20 side was in on the deal, and suffered no sweat. They already had their city-established “citizens committee” ready to morph into a campaign committee, their taxpayer-funded consultant-written draft arguments ready to send to the county elections clerk. Time was no problem. All was peachy-keen.

70% of Measure G-20 tax will be paid by “visitors.” This is a pollster-tested big talking point for proponents. The talking point states that through G-20 tourists will pay their “fair share” of running the city. Huh? Thought they did that through the 13% hotel tax. But no matter.

On its face the 70% claim makes no sense. The city’s largest generator of sales tax is car dealers. Are we to believe tourists come from wherever in their Hummer, stop by the BMW dealer for new wheels, then get a new Hummer engine while they’re at it?

An appendix to the July 21 council agenda report clears up what 70% means. It’s a made-up number based on numerous conjectures. It has less validity than tomorrow’s weather forecast, which at least has science behind it – and admits it’s a forecast, not a fact.

The first problem is there’s no way to accurately apportion taxable sales between residents and “visitors.” There’s only one firm number in the whole show – total taxable and non-taxable retail sales in SLO, about $1.5 billion annually.

So the city hired a pricey economic consultant to concoct a story. The words “estimated” and “assumed” loom large throughout this story.

Key to the 70% “visitor” meme was finding out how much SLO households spend, then subtracting that from the total. The residue must be due to “visitors,” right?

Resident spending was calculated, explains the consultant, “by estimating average annual household spending . . . and multiplying this by the number of households.” This household estimate was based on an assumption that some arcane US Bureau of Labor Statistics estimates were germane to SLO. Estimates built on estimates.

The generic BLS spending estimates assumed household income in the $70K to $99K range, which given SLO’s large number of well-paying tech and professional jobs seems low. The city also has thousands of student households which appear poor based on earned income, but aren’t in spending due to Cal Poly’s attracting the most affluent students in the 23-campus CSU system. Plus the city is seeing an influx of well-off adults from elsewhere. None of this is discussed by the consultant.

Instead, the consultant takes the BLS numbers at face value, thus likely underestimating actual household spending.

Nonetheless, the consultant runs with a firm number for SLO sales to SLO residents based on all those assumptions and estimates, $456 million per year, then subtracts that from total sales to conclude $1 billion of SLO sales are to “non-residents.”

Note the term “non-residents.” In this the economic consultant is not gilding the lily by calling them “visitors.” That alchemy was performed by pollster consultants, city staff and G-20 proponents.

And who might those “non-residents” be? Well, the thousands of Cal Poly students who live on campus are non-residents, as are folk from Los Osos who shop at Target, Costco, and Home Depot. Technically these are indeed non-residents, but they’re part of our community, not “visitors.” Likewise those who work in SLO, but sleep in Atascadero.

As for real “visitors,” our tourists, the consultant punts. After alleging tourists “constitute another large share of non-resident shopping,” the consultant admits “specific data about tourist spending in the city was not available.”

So much for G-20 proponents’ claim “visitors” – i.e., tourists — will pay 70% of G-20’s tax. It’s we the people who will pay.

It’s not over on election day. Given the city’s trickery and consultant-driven promotion of G-20, it’s a foregone conclusion unaware voters will do as the pollsters have planned and approve it, just as they approved its predecessors, Measures Y and G. But election day’s not the end of this.

The “ordinance” mentioned on the ballot is G-20’s potential Achilles heel. An ordinance, or city law, must be passed twice by the council. First passage was July 21. After the election it must be passed again. That means a public hearing where people concerned with the trickery can urge the council to do what’s fair and good. And, if they care to go further, lawyer up. This second passage is tentatively scheduled for Dec. 8, which is also the first meeting of the new council.

The comments below represent the opinion of the writer and do not represent the views or policies of CalCoastNews.com. Please address the Policies, events and arguments, not the person. Constructive debate is good; mockery, taunting, and name calling is not. Comment Guidelines