California lawmakers launch investigation into high gas prices

June 21, 2022

By JOSH FRIEDMAN

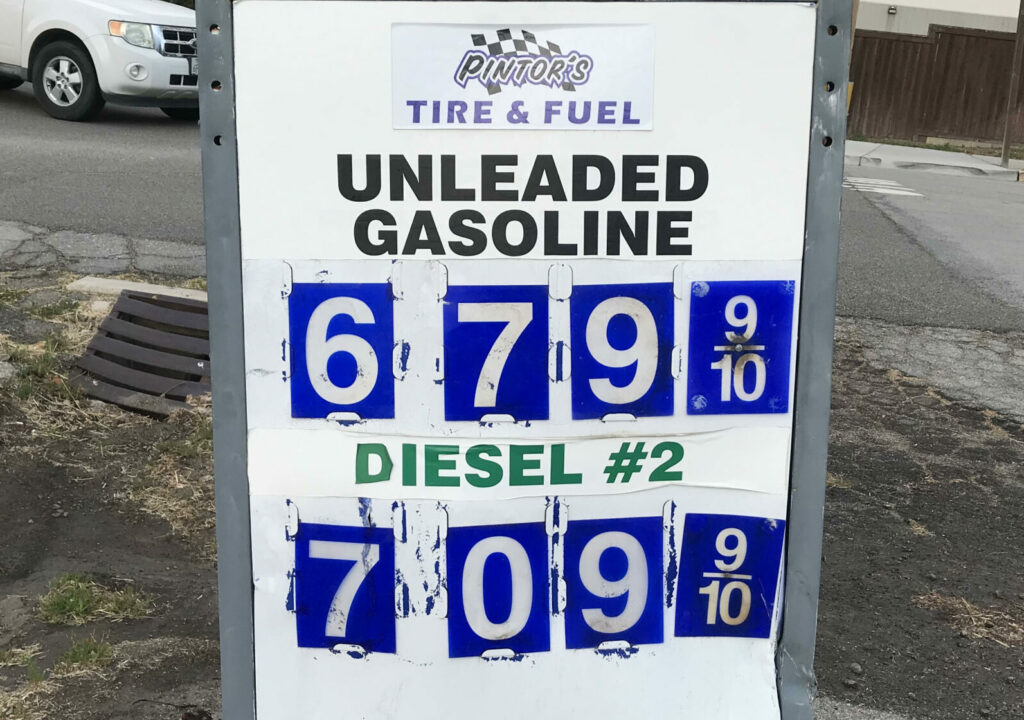

California lawmakers plan to hold committee hearings to investigate the cause of high gas prices in the Golden State as part of a legislative inquiry. [LA Times]

On Monday, Democratic Assembly Speaker Anthony Rendon announced a legislative inquiry to determine if oil companies are “ripping off” drivers. The Assembly select committee will consider what measures the state can enact in order to reduce gas prices and “stand up to the profiteers who are abusing a historic situation to suck profits from California’s wallets,” Rendon said.

Assemblywoman Jacqui Irwin (D-Thousand Oaks) will chair the committee hearings, which are expected to begin in the coming weeks. The hearings could last through November.

“It is no secret that Californians are enduring financial pain at the pump. Amidst global uncertainty, supply chain challenges and COVID there are questions as to why gas prices are at an unprecedented high with no apparent end in sight,” Irwin said. “California leaders must protect consumers from further harm.”

Republican Assembly Leader James Gallagher called the legislative inquiry “another dead-end study.”

For months, Republicans have pushed for a temporary suspension of California’s 51-cent-per-gallon excise tax on gasoline. Republicans have also pushed for suspending the small increase to the gas tax scheduled to take effect July 1.

Gov. Gavin Newsom and Democratic legislative leaders have rejected the proposal. On Monday, Rendon said suspending the gas tax would cut off funding for infrastructure projects and cost jobs, and there is no guarantee oil companies would pass on savings to drivers.

In 2019, Newsom asked the California Energy Commission to conduct an investigation that culminated with a report finding that big corporate gas stations charge “higher prices for what appears to be the same product.” The commission’s report also raised the possibility that competing oil companies were illegally price-fixing.

Following the release of the report, Newsom asked California’s attorney general to investigate whether the state’s leading oil and gas suppliers are involved in price fixing or other unfair practices. The current status of the investigation is unclear.

The comments below represent the opinion of the writer and do not represent the views or policies of CalCoastNews.com. Please address the Policies, events and arguments, not the person. Constructive debate is good; mockery, taunting, and name calling is not. Comment Guidelines