Where did real property values increase in SLO County?

October 9, 2023

By KAREN VELIE

San Luis Obispo County saw a 6.24% increase in the assessed value of real property during the past fiscal year with the largest increases in Paso Robles and San Luis Obispo, according to a SLO County Assessor’s Office report release Monday.

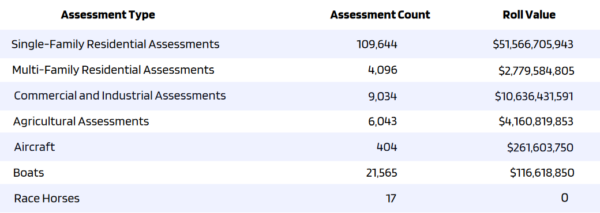

The total assessed value of all property in San Luis Obispo County increased last year by $4,163,367,820 for a total of $71,178,201,493. Changes in ownership, inflation and new construction were the largest factors leading to the increased value.

Where assessed values increased the most:

Paso Robles, up 7.5% with 49 new housing units

San Luis Obispo, up 7.4% with 587 new housing units

Atascadero, up 6.2% with 137 new housing units

Pismo Beach, up 5.8% with 15 new housing units

San Luis Obispo County unincorporated, up 5.7% with 138 new housing units

Arroyo Grande, up 5.7% with 17 new housing units

Morro Bay, up 5.6% with four new housing units

Grover Beach, up 5.5% with 10 new housing units

Where do the taxes go?

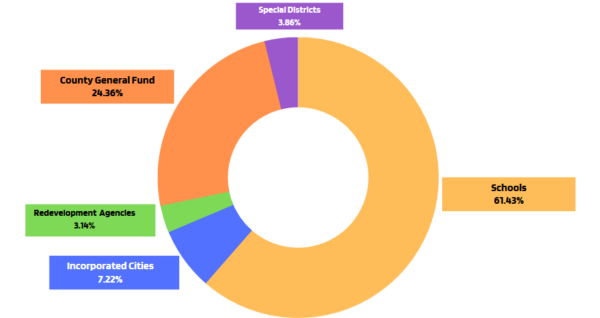

During the 2023-2024 fiscal year, the county is slated to collect $722,246,865 in property tax. Of that, 61% goes to schools, 24% to the county general fund, 7% to cities, 3% to local districts and 3% to redevelopment agencies.

Impacts of Proposition 13:

As part of this year’s annual report, SLO County Assessor Tom Bordonaro focused on the impacts of Proposition 13 and how the 1978 measure has helped keep people in their homes – especially seniors and those on fixed incomes.

Bordonaro noted his support of Proposition 13 shortly after SLO County changed its legislative platform.

On Sept. 12, the SLO County Board of Supervisors voted 3-2 to no longer support the two-thirds majority vote to raise taxes in its state legislative platform, with Supervisor Jimmy Paulding arguing that Proposition 13 does not include two-thirds majority vote requirements.

Proposition 13 limits property taxes to 1% of a property’s assessed value and also includes language requiring a two-thirds majority vote to raise taxes.

In addition, under Proposition 13, property tax assessment increases are limited to no more than 2% per year as long as the property does not have a change in ownership or any new construction.

“When ownership changes or new construction is completed, the property is reassessed at the market value, or the value of the new construction added to the existing assessment,” Bordonaro says in his report. “The reforms under Proposition 13 have provided property owners with the ability to estimate their future property taxes, and to determine the maximum amount their taxes can increase as long as they continue to own the property.”

The comments below represent the opinion of the writer and do not represent the views or policies of CalCoastNews.com. Please address the Policies, events and arguments, not the person. Constructive debate is good; mockery, taunting, and name calling is not. Comment Guidelines