California facing a $58 billion revenue shortfall over 2 years

December 3, 2023

By KAREN VELIE

The California Legislative Analyst’s Office on Friday announced a projected revenue shortfall of $58 billion over two years.

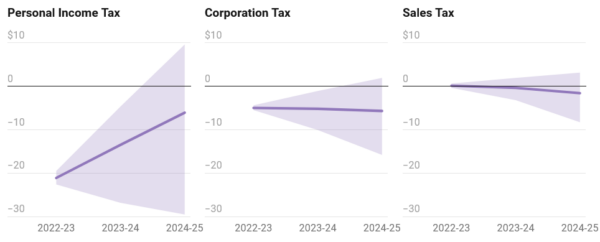

With lower tax revenue and the the impact of recent economic weakness, the state now estimate 2022-23 revenues to be $26 billion lower than expected. Receipts of personal, business and sales tax payments have all fallen below projections.

“Collections data now show a severe revenue decline, with total income tax collections down 25% in 2022-23,” according to the state analyst. “This decline is similar to those seen during the Great Recession and dot-com bust.”

In an effort to cool an overheated U.S. economy, the Federal Reserve has raised interest rates multiple times over the past two years. “This has slowed economic activity in a number of ways. For example, home sales are down by about half, largely because the monthly mortgage to purchase a typical California home has gone from $3,500 to $5,400,” according to the analyst’s office.

Policymakers use the Sahm Rule to track the start of recessions in real time, which was triggered in March. The Sahm Rule has accurately indicated the prior six recessions.

This week, the Legislative Analyst’s Office plans to release its fiscal outlook report, which will discuss the ramifications of the revenue shortfall on the state’s budget.

The comments below represent the opinion of the writer and do not represent the views or policies of CalCoastNews.com. Please address the Policies, events and arguments, not the person. Constructive debate is good; mockery, taunting, and name calling is not. Comment Guidelines