San Luis Obispo County facing $15.3 million budget shortfall

March 23, 2025

By KAREN VELIE

With a looming budget shortfall of more than $15 million, San Luis Obispo County is working on a plan to reduce costs and balance the budget.

SLO County revealed last week it is facing a $15.3 million budget gap for the upcoming fiscal year starting July 1. The county bases its status quo budgets on revenue and costs from the prior year.

However, while revenue is declining the cost of personnel is climbing.

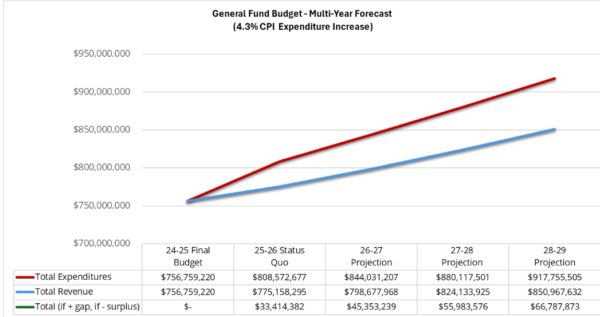

The $15.3 million gap does not account for salary increases that went into effect after Nov. 2024. Taking additional factors into account, SLO County’s budget deficit forecast for the 2025-2026 fiscal year climbs to $33.4 million.

The forecast budget deficit rises to $66.8 million in fiscal year 2028-2029.

California provides 35% (approximately $246 million) of the county’s general fund operating revenue. Because of current fiscal challenges, the state could cut funding.

Another 14% (approximately $100 million) of the county’s operating revenue comes from federal funds, which could also face cuts.

During Tuesday’s SLO County Board of Supervisors meeting, county staff is scheduled to provide a presentation on the upcoming budget shortfalls. In addition, staff will present their “financial rebalancing and resilience initiative.”

The plan is to reduce $40 million from the 2025-2026 fiscal budget, according to the agenda.

County administrators are conducting a comprehensive review of all county programs across all departments. The plan is to look at program impacts, efficacy to the community, costs, outcomes, and alignment with board priorities.

The goal is to construct a budget that adjusts the county’s current spending and prevents recurring deficits and the need for annual budget cuts.

Because we believe the public needs the facts, the truth, CalCoastNews has not put up a paywall because it limits readership. However, we are seeking qualification as a paper of record, which will allow us to publish public notices, this requires 5,000 paid subscribers.

Your subscription will help us to continue investigating and reporting the news.

Support CalCoastNews, subscribe today, click here.

The comments below represent the opinion of the writer and do not represent the views or policies of CalCoastNews.com. Please address the Policies, events and arguments, not the person. Constructive debate is good; mockery, taunting, and name calling is not. Comment Guidelines