SLO County’s unfunded pension liability soaring, now over $1 billion

March 26, 2025

By KAREN VELIE

San Luis Obispo County’s unfunded pension liability is now over $1 billion primarily because of huge pay raises and large cost of living increases for retirees. Other factors include more retirees than current employees (dependency ratio), and retirees living longer.

The SLO County Pension Trust Board reported an unfunded pension debt of $1.008 billion on Jan. 1, up from $943 million a year earlier, according to the Annual Actuarial Valuation report. The county is more than $1 billion short in the trust account set aside to pay former employees their monthly pensions and benefits.

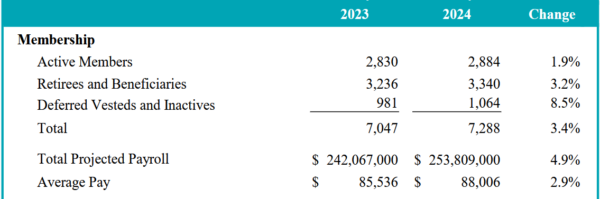

Summary of key valuation results in thousands

For every dollar the county doles out for payroll, more than 54 cents currently goes into the pension trust. This includes both employer and employee contributions.

The county pension fund generally receives money from employee contributions, employer contributions and returns on investments.

In 2023, the pension deficit grew by $65.6 million, or 6.7%.

In addition, projected employee payroll grew by 4.9% to $253.8 million. Pension trust administrators had anticipated a 3% yearly increase in payroll.

The total owed to present and past employees in retirement benefits (actuarial liability) increased more than expected primarily because of large salary increases and higher than expected cost of living raises for retirees (inflation), according to the report.

As the county’s unfunded pension liabilities soar, the number of retirees receiving more than $210,000 in pension and benefits a year is growing, according to Transparent California.

The top SLO County pensioners in 2023:

Frank Freitas, tax collector – $247,730

Jeff Hamm, health agency director – $243,719

Pat Hedges, sheriff-coroner – $219,848

Dan Hilford, assistant district attorney – $219,031

Gerald Shea, district attorney – $218,410

Gere Sibbach, auditor-controller – $213,761

Enn Mannard, medical director – $211,234

The comments below represent the opinion of the writer and do not represent the views or policies of CalCoastNews.com. Please address the Policies, events and arguments, not the person. Constructive debate is good; mockery, taunting, and name calling is not. Comment Guidelines