Chuck Liddell lawsuit goes to jury

June 19, 2015

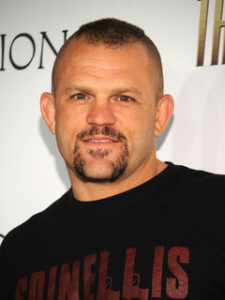

Chuck Liddell

Following a five-week trial, a San Luis Obispo County jury is now deliberating as to whether Cuesta Title Company aided and abetted former North County developer Kelly Gearhart in defrauding mixed martial arts champion Chuck Liddell. [Tribune]

Liddell claims he lost $2 million after his signature was forged on an escrow document. Liddell testified that he purchased four lots at Gearhart’s Vista del Hombre development for $500,000 apiece, but Cuesta Title released his funds before escrow closed and did so without transferring title to the properties.

The document Liddell alleges was forged authorized the release of his money. An attorney for Cuesta Title — now Stewart Title — argued Liddell did sign the document and does not want to take responsibility for putting too much faith in Gearhart.

Gerhart and James Miller, the former president of Hurst Financial Inc., defrauded more than 1,200 investors of more than $100 million in an alleged Ponzi scheme. Gerhart bilked investors who put money into Central Coast real estate projects, like the Vista del Hombre development, and then siphoned off the monies for other purposes, including his extravagant lifestyle.

Liddell testified that he met Gearhart through two friends, brothers Usman and Umer Iqbal, who are also plaintiffs in the trial. One of the brothers told him that Gearhart would trade private flights to MMA fights in exchange for tickets, Liddell said.

Gearhart and Liddell did not socialize, but on one weekend, the developer called him with a business proposal, Liddell said. Liddell decided to invest $2 million for his retirement after consulting his mother and others who told him real estate was a good investment, he said.

Gerhart told Liddell to go to Cuesta Title and work with Melanie Schneider, the escrow officer who handled Gearthart’s deals, Liddell said. Liddell did not know that Schneider had $50,000 invested in the Vista del Hombre development.

Kelly Gearhart

Sources told CalCoastNews Schneider moved to Colorado with Gearhart’s brother, Doug Gearhart, shortly after the fall of Hurst Financial. Schneider also reportedly flew on Gearhart’s private jet and briefly lived in his guest house while she was friends with Gearhart’s wife.

Schneider testified that up to 80 percent of the escrows at her branch were related to Gearhart, but she did not know Gearhart was committing fraud. Liddell’s attorney said Schneider knew about the fraud and had a vested interest in making the deal go through.

Multiple lawsuits claim employees of Cuesta Title aided and abetted and/or conspired with Miller and Gearhart. Cuesta Title created false escrows, falsely closed active escrows and illegally filed clean title reports before placing additional loans on already encumbered properties, according to lawsuits.

Some investors have lost their claims in court, while others have received a portion of their losses from the title companies.

In May 2014, Gearhart pleaded guilty to two counts of wire fraud and one count of money laundering in Los Angeles federal court. Gerhart is due to be sentenced on June 29.

Prior to sentencing, the court will hold an evidentiary hearing in which the government plans to ask for a 135-month sentence. Gearhart will introduce evidence in support of the 57 months’ imprisonment he seeks.

The statutory maximum is 50 years in federal prison.

Gearhart’s questionable financial dealings were brought to light in a lengthy, ongoing series of articles by CalCoastNews starting in 2008.

The comments below represent the opinion of the writer and do not represent the views or policies of CalCoastNews.com. Please address the Policies, events and arguments, not the person. Constructive debate is good; mockery, taunting, and name calling is not. Comment Guidelines