SLO County’s unfunded pension liability soaring, nearly $1 billion

August 30, 2023

By KAREN VELIE

San Luis Obispo County’s unfunded pension liability is almost $1 billion, primarily because of huge pay raises and poorly performing investments.

The SLO County Pension Trust Board of Trustees reported an unfunded pension debt of $943 million on Jan. 1, up from $879 million a year earlier, according to the Annual Actuarial Valuation report released in June. The county is almost $1 billion short in the trust account set aside to pay former employees their monthly pensions and benefits.

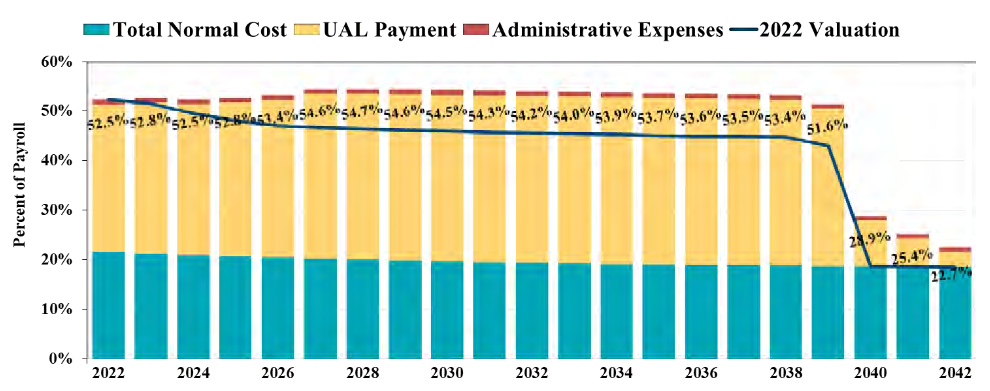

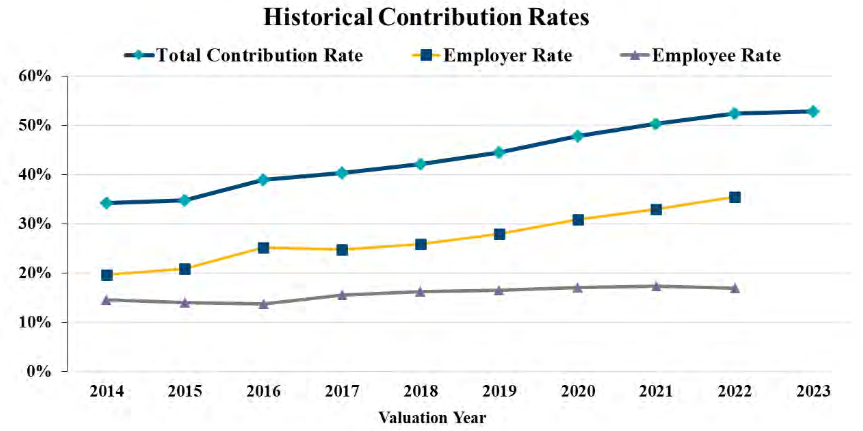

For every dollar the county doles out for payroll, more than 50 cents currently goes into the pension trust. In 2022, the pension deficit grew by $64 million, or 7%.

UAL is the payment to cover the unfunded liability

The county pension fund generally receives money from employee contributions, employer contributions and returns on investments.

However, with a 7.7% loss in the market value of assets, “investment returns were less than favorable,” according to the report.

In addition, projected employee payroll grew by 8.1% to $242.1 million. Pension trust administrators had anticipated a 3% yearly increase in payroll. However, while in 2022 line-level employees received pay increases of 3%, county officials, administrators and management staff were given raises of up to 23%.

As the county’s unfunded pension liabilities soar, the number of retirees receiving more than $200,000 in pension and benefits a year is growing, according to Transparent California.

The top SLO County pensioners in 2022:

Frank Freitas, tax collector – $240,572

Jeff Hamm, health agency director – $225,021

Pat Hedges, sheriff-coroner – $213,496

Dan Hilford, assistant district attorney – $212,702

Gerald Shea, district attorney – $212,099

Gere Sibbach, auditor-controller – $207,584

Enn Mannard, medical director – $205,130

The comments below represent the opinion of the writer and do not represent the views or policies of CalCoastNews.com. Please address the Policies, events and arguments, not the person. Constructive debate is good; mockery, taunting, and name calling is not. Comment Guidelines