Which San Luis Obispo County ballot measures are likely to pass?

November 10, 2024

By KAREN VELIE

San Luis Obispo County voters were asked on Nov. 5 to raise sales tax, stop electing a treasurer, stop industrialization, and repeal increases in water bills. With about two-thirds of votes counted what local measures are succeeding?

Arroyo Grande’s Measure E-24, sales tax increase

A measure to increase sales tax by 1%, which Arroyo Grande City staff estimates will result in $6 million a year in additional revenue, is passing with 59% voting yes. Measure E-24 will raise the sales tax rate in Arroyo Grande from 7.75% to 8.75%.

The proposed 1% sales tax increase is set to sunset in ten years.

Atascadero’s Measure L-24, sales tax increase

A measure to extend a 2014 half cent sales tax is passing by 70.80% to 29.20%. Atascadero’s sales tax will remain at 8.75%.

Atascadero’s current sales tax rate will continue unless residents vote to repeal it. City staff estimates Measure L-24 will result in $3 million a year in additional revenue.

Atascadero Measure M-24, appoint the city treasurer

A measure to transition from electing a city treasurer to appointing the top financial officer for Atascadero is currently failing 50.9% to 49.10%. However, the race is still to close to call.

Grover Beach Measure G-24, lower water and sewer rates

A measure to repeal Grover Beach’s 112% water and sewer rate increase is winning by 65.45% to 34.55%.

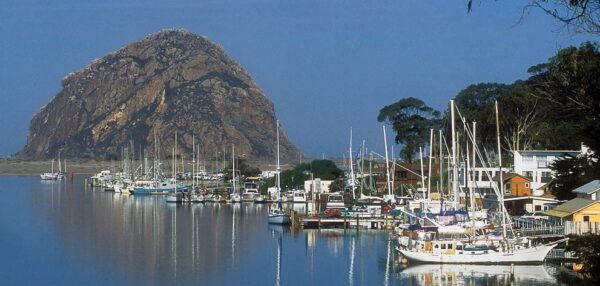

Morro Bay Measure A-24, require voter approval for industry on the waterfront

A measure requiring voter approval for changes to some zoning on the waterfront is passing by 59% to 41%. While Morro Bay residents opposed to the industrialization of the Morro Bay waterfront are winning, Vistra Energy, the company behind a proposed battery storage facility, has decided to seek state approval while bypassing the city’s consideration.

Paso Robles’ Measure I-24, sales tax increase

A measure to extend the 2012 half cent sales tax, which is set to expire in 2025, is passing by 54.88% to 45.12%. Paso Robles’ sales tax will remain at 8.75%. The increase will continue unless residents vote to repeal it.

City staff estimate Measure I-24 will result in $5.5 million a year in additional revenue.

Pismo Beach’s Measure F-24, sales tax increase

A measure to increase the sales tax by .5% and to extend a previously approved .5% sales tax measure is passing 62.29% to 37.71%. The new Pismo Beach sales tax rate will be 8.25%

City staff estimates the increase in sales tax will result in $4 million a year in additional revenue.

Because we believe the public needs the facts, the truth, CalCoastNews has not put up a paywall because it limits readership. However, we are seeking qualification as a paper of record, which will allow us to publish public notices, but it requires 5,000 paid subscribers.

Your subscription will help us to continue investigating and reporting the news.

Support CalCoastNews, subscribe today, click here.

The comments below represent the opinion of the writer and do not represent the views or policies of CalCoastNews.com. Please address the Policies, events and arguments, not the person. Constructive debate is good; mockery, taunting, and name calling is not. Comment Guidelines