Credit card delinquencies rising in California

December 10, 2024

By KAREN VELIE

Last year, 11% of California cardholders had three months or more of delinquent credit card debt.

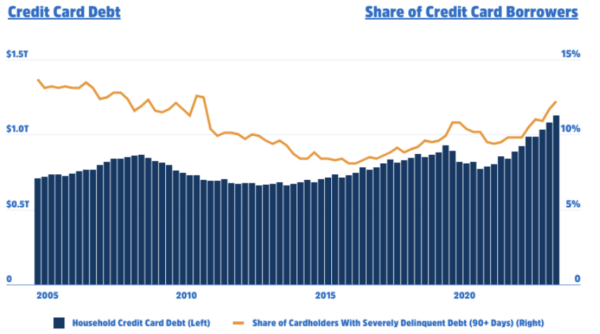

This year’s holiday spending is expected to push the nation’s $1.17 trillion in household credit card debt even higher—and with rising debt, cardholders are increasingly at risk of falling behind on their payments. A new analysis from Upgraded Points sheds light on credit card delinquency rates in the United States, and also broken down by state.

Credit Card Delinquency in California

- Last year, 11% of cardholders in California had severely delinquent debt, at least 90 days overdue.

- The average credit card debt in California was $6,842.

- Additionally, 24.8% of California cardholders utilized more than 75% of their total credit, which can hurt credit scores and make it more difficult to secure loans or favorable interest rates in the future.

The comments below represent the opinion of the writer and do not represent the views or policies of CalCoastNews.com. Please address the Policies, events and arguments, not the person. Constructive debate is good; mockery, taunting, and name calling is not. Comment Guidelines