Where did real property values increase in San Luis Obispo County?

November 3, 2025

By KAREN VELIE

San Luis Obispo County saw a 4.74% increase in the assessed value of real property during the past fiscal year with the largest increases in the cities of San Luis Obispo and Paso Robles, according to a SLO County Assessor’s Office report released Friday. Local cities and the county governments are funded primarily through a combination of property tax, sales tax, and transient occupancy tax revenues.

The total assessed value of all property in San Luis Obispo County increased last year by $3,548,185,401 for a total of $78,306,791,129. Changes in ownership and new construction were the largest factors leading to the increased value.

Where assessed values increased the most:

Arroyo Grande up $167,110,683 – 3.9%

Atascadero up $240,994,798 – 4.3%

Grover Beach up $134,818,590 – 5.7%

Morro Bay up $171,745,637 – 4.9%

Paso Robles up $367,812,38 – 5.2%

Pismo Beach up $193,934,310 – 4.1%

San Luis Obispo up $900,038,213 – 6.6%

San Luis Obispo County unincorporated up $1,609,877,171 – 4.5%

Why was there an increase in exemptions?

Property tax exemptions increased from $1,819,751,833 to $2,069,034,522 – 13.6%. Exemptions are permitted for welfare, churches, government and nonprofit owned properties. Partial exemptions are available for primary residencies.

Under Proposition 13, property tax assessment increases are limited to no more than 2% per year as long as the primary residence does not have a change in ownership or any new construction.

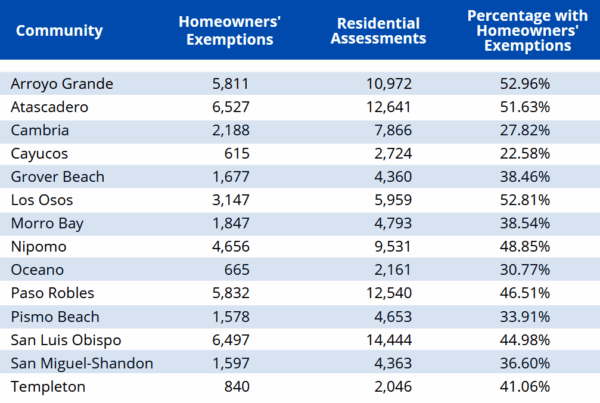

The percentage of homeowner exemptions in a city vary by the number of rental units and second homes in the community. For example, while 52% of homes in Arroyo Grande include homeowner exemptions, only 22% of homes in Cayucos have homeowner exemptions.

In the past few years, the county lost significant tax revenue as mutiple properties were purchased by nonprofits, including Adventist Health’s purchase of Sierra Vista Regional Medical Center in SLO and Twin Cities Community Hospital in Templeton, and the Cal Poly Corporation purchase of an apartment building in the San Luis Ranch development in SLO.

Where do the taxes go?

During the 2025-2026 fiscal year, the county is slated to collect $793,095,355 in property tax. Of that, 61% goes to schools, 24% to the county general fund, 7% to cities, 3% to local districts and 3% to redevelopment agencies.

Impacts of Proposition 19:

As part of this year’s annual report, SLO County Assessor Tom Bordonaro warns that implementing Prop. 19 will result in turbulent times for taxpayers. “The assessor’s office will endeavor to work with each property owner impacted by the changes under Prop. 19 to maximize tax savings and benefits.”

Prop. 19 imposes new limits on property tax benefits for inherited family property. Under Prop. 19, children may keep the lower property tax base of their parents only if the property was the principal residence of the parent and the child, or if the child makes it their principal residence within one year of the transfer.

The comments below represent the opinion of the writer and do not represent the views or policies of CalCoastNews.com. Please address the Policies, events and arguments, not the person. Constructive debate is good; mockery, taunting, and name calling is not. Comment Guidelines